Joustoluotto

Joustoluotto on vakuudeton laina, joka sopii niin isompiin kertahankintoihin kuin arkisten ostosten tekoon. Kerran myönnettyä joustoluottoa voi käyttää jatkuvasti ilman, että sinun täytyy hakea lainaa uudestaan. Edullisin joustoluotto löytyy Top5Credits.comin avulla, jossa joustoluottojen vertailu on helppoa ja nopeaa. Ilmainen joustoluottovertailumme kertoo sinulle muun muassa lainan todellisen vuosikoron ja oleelliset lainaehdot. Olemme hakeneet joustoluottotarjouksia, jotta voisimme suositella sinulle oikeita vaihtoehtoja.

Muokkaa ![]()

| Laina-aika | 1 - 15 vuotta |

| Korko * | 8.79 - 28.98% |

| Lainasumma | 1 000 - 60 000 € |

- Kilpailukykyinen korko

- Lainapäätös heti

- Voit valita itsellesi sopivan laina-ajan

| Laina-aika | 1 - 15 vuotta |

| Korko * | 4.00 - 38.00% |

| Lainasumma | 2 000 - 60 000 € |

- Laajasti pankkeja ja luotonmyöntäjiä

- Nopea vastaus hakemukselle

- 4.2 ⭐ asiakkaiden arvostelut Trustpilotissa

| Laina-aika | 1 - 15 vuotta |

| Korko * | 4.00 - 30.00% |

| Lainasumma | 2 000 - 60 000 € |

- Yksi hakemus - useampi tarjous

- Pohjoismainen toimija

- 4.6 ⭐ asiakkaiden arvostelut Trustpilotissa

| Laina-aika | 10 - 16 vuotta |

| Korko * | 3.10 - 15.80% |

| Lainasumma | 2 000 - 50 000 € |

- Matala korko

- Maksuohjelma on joustava

- 2 lyhennysvapaata per vuosi

- Laina-aika enintään 5,5 vuotta.

- Halvin korko vain Premium-asiakkaille

| Laina-aika | 1 - 18 vuotta |

| Korko * | 4.00 - 38.00% |

| Lainasumma | 500 - 60 000 € |

- 5 räätälöityä lainatarjousta

- Auttaa kaikkia hakijoita

- Ilmainen palvelu

| Laina-aika | 1 - 15 vuotta |

| Korko * | 4.00 - 29.99% |

| Lainasumma | 1 000 - 60 000 € |

- Kilpailuta 20 pankkia ja luotonmyöntäjää kerralla

- Selkeä lainatarjousten vertailu

- Mysafetyn Identiteettivakuutus maksutta käyttöösi 3kk:n ajaksi

| Laina-aika | 1 - 15 vuotta |

| Korko * | 4.59 - 38.00% |

| Lainasumma | 500 - 60 000 € |

- Kilpailuta laina jopa 25 luotonantajalla

- Myös yhdistelylainat

- Saat lainatarjouksia heti

| Laina-aika | Joustava |

| Korko * | 29.08% |

| Lainasumma | 100 - 2 000 € |

- Helppo ja nopea hakemus

- Lainapäätös heti

- Voit nostaa rahaa joustolimiitiltä aina kun tarvitset

- Lyhennysvapaa kuukausi on maksullinen

| Laina-aika | 1 - 15 vuotta |

| Korko * | 4.19 - 29.90% |

| Lainasumma | 500 - 60 000 € |

- Yli 30 pankkia ja luotonmyöntäjää

- Sujuva hakemus yhdellä sivulla

- Rahat tilille jopa samana päivänä

| Laina-aika | 1 - 15 vuotta |

| Korko * | 4.50 - 38.00% |

| Lainasumma | 1 000 - 60 000 € |

- Mukana yli 20 pankkia ja luotonmyöntäjää

- Isompia pankkeja mukana

- Hyvä asiakaspalvelu

| Laina-aika | 1 - 12 vuotta |

| Korko * | 9.37 - 24.96% |

| Lainasumma | 5 000 - 50 000 € |

- Edullinen korko

- Hyvä asiakaspalvelu

- Selkeä hinnoittelu

- Lainaa vain pankin asiakkaille

- Kallis tilinhoitomaksu

| Laina-aika | 2 - 47 kk |

| Korko * | 28.48% |

| Lainasumma | 100 - 3 000 € |

- Helppo ja nopea hakemus

- Rahat nopeasti käyttöön

- Ensimmäinen nosto rajattu

| Laina-aika | 1 - 18 vuotta |

| Korko * | 8.90 - 27.10% |

| Lainasumma | 500 - 60 000 € |

- Yhdellä hakemuksella monta tarjousta

- Mukana myös perinteisempiä pankkeja

- Kilpailuttaa myös asuntolainoja

- Hieman epäselvä vertailu

- Hankala nettisivu

| Laina-aika | 3 - 54 kk |

| Korko * | 28.58% |

| Lainasumma | 1 - 4 000 € |

- Lainaa heti tilille

- Joustava takaisinmaksu

- Avausmaksu ja nostokulut 0€

- Keskivertoa korkeampi korko

| Laina-aika | 1 - 15 vuotta |

| Korko * | 4.50 - 30.60% |

| Lainasumma | 2 000 - 60 000 € |

- Lainatarjoukset esitetään selkeästi

- Hyvät tiedot eri pankkien lainaprosesseista

- Asiakaspalvelu kätevästi myös chatissa

- Ei tietoa siitä, mitkä pankit ja luotonmyöntäjät mukana

- Ei kerro, mitkä pankit hylkäävät hakemuksesi

| Laina-aika | 1 - 15 vuotta |

| Korko * | 4.95 - 38.00% |

| Lainasumma | 500 - 60 000 € |

- Selkeät lainatarjoukset

- Nopea lainahakemus

- Kertoo myös mitkä pankit hylkää

- Osa tarjouksista alustavia ja vaatii uuden hakemuksen

| Laina-aika | 2 - 15 vuotta |

| Korko * | 9.74 - 22.12% |

| Lainasumma | 2 000 - 50 000 € |

- Nopea asiakaspalvelu

- Kilpailukykyinen korko

- Lainaa voi hakea ilman tunnistautumista

- Lainan todellisessa vuosikorossa oli "laskuvirhe"

- Hakemuksen liitteet käsitellään hitaasti

| Laina-aika | 1 - 15 vuotta |

| Korko * | 5.00 - 32.00% |

| Lainasumma | 500 - 60 000 € |

- Useita eri pankkeja

- Valitse laina itse

- Myös yhdistelylainat vakuudella

Top5Credits.com on täysin ilmainen palvelu, jonka tarkoitus on antaa käyttäjilleen hyödyllistä tietoa ja sisältöä. Vertailemme lainoja ja arvostelemme lainapalveluita rehellisesti. Jotta voimme pitää palvelun ilmaisena, saamme yhteistyökumppaneiltamme palkkion heille ohjatuista asiakkaista ja palkkion suuruus vaikuttaa listauksen järjestykseen.

Mikä on joustoluotto?

Joustoluoton toimintaperiaate on sama kuin luottokorteissa tai kulutusluotoissa. Kerran myönnetty joustoluotto on jatkuva ja joustava laina, jota voit nostaa luottolimiittisi puitteissa yhä uudestaan. Kortin sijaan sinulla on luottotili, josta voit siirtää rahaa käytettäväksi. Myönnetty lainasumma määrittää luoton maksimimäärän.

Nimensä mukaisesti joustoluoton laina-aika on joustava ja yleensä lainaa voi lyhentää itselleen sopivalla summalla kuukausittain. Halutessasi voit tehdä muutoksia takaisinmaksuun maksamalla kerralla enemmän tai siirtämällä eräpäivää. Lainan lyhentäminen vapauttaa aina luottoa käyttöön. Palvelumme laskee valmiiksi, paljonko arvioitu kuukausierä olisi hakemallesi summalle.

Top5Credits vertailee joustoluotot puolestasi

Joustoluottoja, käyttöluottoja ja lainoja tarjoavia luotonmyöntäjiä mahtuu markkinoille monta. Kotimaisten pankkien ja rahoitusyhtiöiden lisäksi luottomarkkinoilla on useita ulkomaisia vaihtoehtoja, joista jokainen tarjoaa lainaa eri ehdoin. Ehtojen lisäksi eroa voi olla, esimerkiksi kenelle lainaa myönnetään, lainan kuluissa eli mikä on lainan todellinen vuosikorko ja paljonko lainaa myönnetään.

Top5Credits.comin avulla saat listattua luotonmyöntäjät erilaisin hakukriteerein ja vertailtua helposti. Määrittele vertailuun hakemasi lainasumma ja halutessasi valitse esimerkiksi, mahdollisuus lyhennysvapaisiin kuukausiin ja hakukoneemme etsii sinulle sopivimmat lainantarjoajat. Vertailumme ansiosta näet helposti eri lainanmyöntäjien korot ja kulut, perustiedot sekä hyvät ja huonot puolet. Lisäksi suosittelemme, että tutustut arvioomme, jonka lopusta löydät käyttäjien arvosteluja ja kokemuksia kyseisestä lainayhtiöstä.

Vertailu perustuu hakemaasi joustoluoton määrään ja laina-aikaan, joka määrittää kuukausittaisen lyhennyserän. Näiden pohjalta näet, minkälaisia kuluja joustoluottoosi tulee, paljonko nostopalkkiot ovat ja tuleeko käsittelykuluja kuukausittain. Toisin sanoen kerromme, paljonko joustoluoton todellinen vuosikorko on. Vertailu kannattaa, sillä ero edullisimman ja kalleimman joustoluoton välillä saattaa olla suuri. Pienellä vaivannäöllä voit säästää selvää rahaa.

Voit hakea joustolainaa 60 000 euroon asti ilman vakuuksia

Joustoluottoa voi hakea muutamista sadoista useisiin tuhansiin euroihin. Yleensä joustoluotto on määrältään 2 000 -5 000 euroa, mutta osa rahoituslaitoksista tarjoaa joustoluottoa jopa 60 000 euroon asti. Isoja lainoja haettaessa lainanhakuprosessi kestää yleensä kauemmin, koska lainantarjoaja haluaa varmistua takaisinmaksukyvystäsi.

Joustoluottojen kohdalla kannattaa pitää mielessä, että korkoa maksetaan ainoastaan nostetusta summasta. Luottoa ei siis kannata nostaa enempää kuin on tarvetta. Lainaa saa kuitenkin nopeasti haettua lisää, mikäli sille tulee tarvetta.

Vakuudeton joustoluotto heti tilille

Internetin ansiosta lainaa voi nykyään saada todella nopeasti, eikä joustoluotto ole tästä poikkeus. Useimmat luotonmyöntäjät ovat automatisoineet lainanhakuprosessinsa osittain tai kokonaan, mikä nopeuttaa lainan myöntämistä huomattavasti. Yleensä lainantarjoajat lupaavat rahat tilille viimeistään muutaman päivän kuluessa, mutta parhaimmillaan rahat voi saada jo saman päivän aikana.

Nopeinten joustoluoton saa hakemalla luottoa verkossa toimivilta rahoituslaitoksilta ja luotonmyöntäjiltä. Top5Creditsin lainavertailu vertailee vain luotettavia ja hyviksi havaittuja lainapalveluita. Pankkien tarjoamat joustoluotot ovat myös hyviä, mutta prosessi on yleensä hieman hitaampi verkossa toimiviin palveluihin verrattuna.

Joustoluotot & korko

Joustoluotto on laina ilman vakuuksia, mikä tarkoittaa, että voit hakea joustoluottoa ilman erillisiä vakuuksia tai takaajia. Myönnetty joustoluotto on hinnaltaan yleensä hieman korkeampi kuin vakuudellinen laina, mutta huomattavasti joustavampi käytön ja takaisinmaksun osalta. Joustoluotossa maksat korkoa vain nostamallesi summalle, et koko lainasummalle. Luottolimiittisi voi siis olla korkeampi kuin todellinen rahantarve. Koron osuus pienenee sitä mukaa, kuin lainaa maksetaan takaisin.

Joustoluotoissa on tyypillisesti aloitusmaksu ja korko sekä käsittely- ja lainanhoitokulut, joista muodostuu todellinen vuosikorko. Todellinen vuosikorko kertoo, kuinka paljon joustoluotto tulee sinulle maksamaan. Näissä on tuntuvia eroja eri luotonmyöntäjien välillä, joten vertailu avulla voit säästää lainanhoitokuluissa satoja tai joskus jopa tuhansia euroja, lainasummasta riippuen.

Joustoluoton luottoraja ja korko määräytyvät sen mukaan, minkälainen maksukyky lainaajalla on. Lainantarjoajat kartoittavat jokaisen hakijan maksukyvyn erikseen ja antavat sen perusteella lainatarjouksen.

Kilpailuttamalla joustoluottoja varmistut siitä, että löydät parhaan mahdollisen joustoluoton tarpeisiisi. Tyypillisen joustoluoton korko on 4-20 prosentin väliltä. Erilaiset avaus- ja tilinhoitomaksut voivat kuitenkin nostaa todellisen vuosikoron 30 prosentin tasolle.

Mihin joustava laina sopii?

Joustolaina on monipuolinen lainatuote joustavuutensa ansiosta. Voit nostaa lainan kerralla tai kuluttaa pienemmissä osissa. Erityisen hyvin joustava laina sopii arjen yllättäviin tilanteisiin. Joustolainalla voi myös helpottaa tilapäistä taloudellista ahdinkoa, kunhan lainaa ottaa oman maksukyvyn rajoissa.

Erityisesti joustolaina pääsee oikeuksiinsa remonteissa ja muissa vaikeasti budjetoitavissa asioissa, joissa usein ilmenee yllättäviä lisäkuluja, joihin on vaikea ennakkoon varautua. Joustava laina voi mahdollistaa lisärahoituksen, jolloin esimerkiksi keskeneräinen remontti saadaan valmiiksi. Paras joustolaina löytyy lainavertailun avulla.

Joustavaa lainaa ei kannata harkita, jos tulot ovat olemattomat tai olet työtön. Tällaisissa tilanteissa takaisinmaksun kanssa voi tulla suuria ongelmia. Lainaa otettaessa on aina oltava varma, että tarvittavista maksuista selviytyy ilman suurempia ongelmia.

Joustoluotto sopii:

✅ Remonttiin

✅ Muut vaikeasti budjetoitavat asiat, kuten muutto

✅ Arjen yllättävät menot

Joustoluotto sopii huonosti:

❌ Toisen lainan poismaksamiseen

❌ Lainojen yhdistelyyn

❌ Pelaamiseen

❌ Juhlimiseen

Joustolainan takaisinmaksu

Joustolainan laina-aika on yleensä 1-36 kuukautta, mutta isoja joustoluottoja voi saada jopa 15 vuoden takaisinmaksuajalla. Laina-aika kannattaa kuitenkin aina pitää mahdollisimman lyhyenä ja suunnitella etukäteen. ennen kuin haet joustolainaa.

Yleensä joustolainoissa on vähimmäismaksuerä kuukautta kohden, mutta tätä suuremman lainaerän maksaminen onnistuu. Vähimmäismaksu on määritetty lainaehdoissa. Tavallisesti koko lainan maksaminen kerralla tai suuremmissa erissä on ilmaista, mutta takaisinmaksuehdot kannattaa aina tarkistaa lainantarjoajalta. Joustolainaan on usein mahdollista saada myös kaksi maksuvapaata kuukautta.

Joustoluotto on erilainen, kuin kerran haettava kertaluotto. Sitä voi käyttää yhä uudelleen, kunhan lyhentää lainaa säännöllisesti. Tämä on hyvä pitää mielessä joustoluottoja vertaillessa.

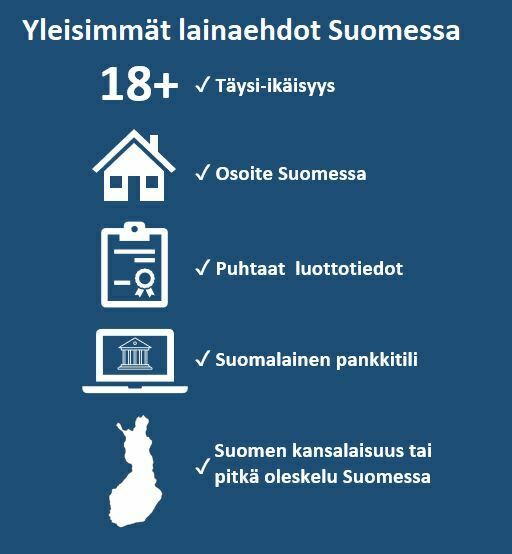

Kuka voi hakea joustolainaa verkosta?

Verkosta joustolainaa voivat hakea täysi-ikäiset henkilöt, joilla on säännölliset ansiot ja vakituinen työpaikka. Muita kriteerejä ovat yleensä tietyn suuruiset palkkatulot tai ettei hakijalla ole maksuhäiriömerkintää, mutta nämä riippuvat lainantarjoajasta. Nykyään on olemassa rahoituslaitoksia, kuten Bluestep ja Svea, jotka myöntävät lainaa esimerkiksi yksityisyrittäjille ja niille, joiden menneisyydestä saattaa löytyä maksuhäiriömerkintä.

Voit tarkistaa minimivaatimukset ja ehdot vierailemalla lainantarjoajan verkkosivuilla tai lukemalla arvostelujamme.

Kuinka paljon joustolainaa voi saada?

Joustoluottoa voi saada ihan muutamista kympeistä useisiin tuhansiin euroihin. Yleensä joustoluottoa haetaan kuitenkin muutamia tuhansia euroja. Jotkin rahoituslaitokset voivat tarjota joustoluottoa jopa 60 000 euroa. Isoja lainoja haettaessa prosessi on yleensä hieman pidempi, koska lainantarjoaja haluaa varmistua siitä, että lainaaminen on järkevää.

Joustoluotoissa kannattaa pitää mielessä, että luottoa kannattaa nostaa vain sen verran, kuin sitä tarvitsee, koska korkoa maksetaan nostetusta osuudesta. Luottoa saa kuitenkin helposti ja nopeasti lisää, mikäli sille tulee tarvetta.

Joustoluoton luottoraja ja korko määräytyvät sen mukaan, minkälainen maksukyky lainaajalla on. Lainantarjoajat kartoittavat jokaisen hakijan maksukyvyn erikseen ja antavat sen perusteella tarjouksen.

Miten parannan mahdollisuuksiani saada joustoluottoa?

Voit parantaa mahdollisuuksiasi saada lainaa usealla eri tavalla. Olemme listanneet alle muutaman selkeän toimenpiteen, joiden avulla voit saada joustoluoton todennäköisemmin ja paremmilla ehdoilla.

- Hae joustoluottoa useasta eri paikasta

- Hanki vakituiset tulot (työ- tai eläketulot)

- Maksa vanhat lainat pois, ennen joustolainan hakemista

- Hae lainaa rinnakkaishakijan kanssa

Joustoluoton korottaminen

Joustoluoton määrää on usein mahdollista korottaa. Osa luotontarjoajista myöntää korotuksen ilman erillistä lisämaksua tai veloitusta, kuten Nordea. Mikäli haluat korottaa joustoluottoasi, sinun kannattaa ottaa yhteyttä lainantarjoajaasi..

Joustoluotto esimerkki

Esimerkissä on 10000 euron joustoluotto, josta nostetaan 2 000 euroa. Tämän jälkeen joustoluottoa on käytettävissä vielä 8 000 euroa, mikäli lisärahoitukselle tulee tarvetta.

2 000 euron joustoluottoa lyhennetään 500 eurolla, jonka jälkeen joustavaa lainaa on käytössä 8 500 euroa. Esimerkki osoittaa, kuinka joustava ja monikäyttöinen laina joustoluotto on. Sen toimintaa verrataan usein luottokorttiin.

Mistä edullisin joustoluotto?

Vertaamme sivustollamme yli 50 pankkia, rahoituslaitosta ja lainanvälittäjää. Joustoluotto vertailussa on mukana tunnettuja ja hieman tuntemattomampia joustoluotontarjoajia, kuten: Nordea Joustoluotto, OP joustoluotto, Morrow Bank, Ferratum ja Instabank. Aloita edullisen joustoluoton hakeminen Top5Credits.comin avulla.

Joustoluotto kokemuksia

Voit lukea joustoluotto kokemuksia lainantarjoajista Top5Credits.comin arvostelut-sivuilta. Olemme arvostelleet useita eri joustoluottoa tarjoavia pankkeja ja rahoituslaitoksia. Suosittelemme lukemaan arvosteluja ennen lainan hakemista, sillä olemme hakeneet oikeita lainatarjouksia ja listanneet selkeästi eri palveluiden plussat ja miinukset. Arvostelun lopusta voit vielä lukea muiden asiakkaiden kommentteja lainantarjoajasta, jotka voivat tarjota arvokasta tietoa lainan hakemiseen.

Usein kysytyt kysymykset

Joustoluotto on joustava laina, joka toimii luottokortin tavoin. Voit hakea lainaa enemmän kuin tarvitset ja nostaa lainan kerralla tai pienemmissä osissa. Korkoa maksat vain nostamasi lainan mukaan. Lyhentämällä lainaa vapautat luottoa käyttöösi.

Tyypillisesti joustoluoton korko vaihtelee 4-20 % välillä. Erilaiset avausmaksut ja kuukausikulut saattavat kuitenkin nostaa todellisen vuosikoron jopa 30 % tasolle. Korkoa maksetaan vain nostetusta lainasta.

Paras joustoluotto löytyy helposti vertailemalla Top5Credits.comin avulla. Olemme tutustuneet arvosteluissa luotonmyöntäjiin, listanneet niiden hyvät ja huonot puolet sekä laskeneet, paljonko todellinen vuosikorko lainalle on.

Joustava luotto on tyypillisesti muutamasta tuhannesta eurosta 10 000 euroon asti, mutta joustoluottoa on mahdollista saada jopa 60 000 euroa. Luottorajaan vaikuttaa aina hakijan taloudellinen tilanne.

Voit hakea joustoluottoa, jos olet täysi-ikäinen, sinulla on vakituiset tulot ja luottotietosi ovat kunnossa.